Australia is gaining from an increase in global energy prices on prospects that the war in Europe will worsen global oil and gas shortages as nations avoid supplies from Russia, according to the Australian government forecaster.

Western sanctions on Russian energy exports are causing a market disruption and will keep prices high, said the Australian Department of Industry, Science, Energy and Resources, which boosted its outlook for resources and energy exports this fiscal year and next.

Some consumers have switched from Russia as a source of natural gas and LNG, it said, which points to increased thermal coal consumption amid the shortage of energy supplies.

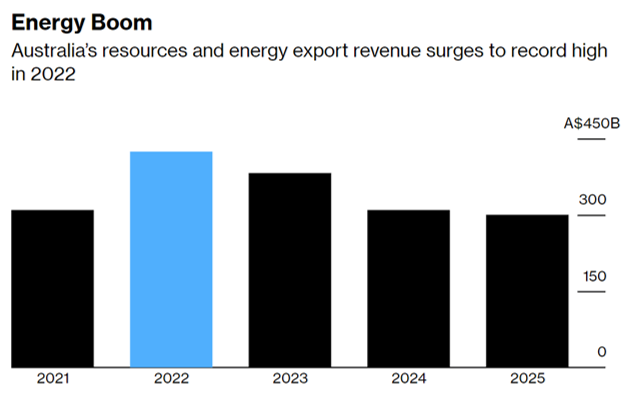

Source: Australian Department of Industry, Science, Energy and Resources NOTE: Figures are for the financial year to end-June

Australian Commodity Export Forecasts

Exports are expected to hit a record A$425 billion ($319 billion) in the year to June 30, 2022 (revised up by 12% from the December estimate) before dropping to A$381 billion in the following 12 months on account of falling prices amid decreasing demand growth and elevated global output.

Commodity trade is shifting rapidly due to the war. Russian commodities that would normally head to developed nations are now being eschewed by some users, and may be diverted to China and India. China and India may then have less need for non-Russian cargoes, and these could be diverted to developed nations, the department said.

Still, prices for coal and LNG are likely to fall noticeably after 2022 as global supply lifts and demand growth moderates. Demand over time would be impacted as efforts to reduce emissions are likely to come back into focus once energy security can be assured, according to the report.

Exports are expected to hit a record A$425 billion ($319 billion) in the year to June 30, 2022

Australian Government Expectations

The government expects growing demand for metals — including copper, aluminium, lithium and nickel — as global electric vehicle sales surge and new energy technologies emerge.

Supply should slowly catch up with demand, leading to a slide in prices as stockpiles build. Meanwhile, energy export volumes are forecast to show only minor growth during the outlook period as record-high prices will impact adversely on near-term demand.

The report noted that a risk to the outlook are higher global interest rates that may threaten global economic activity, a prospect that would dampen the resource and energy export forecasts.

AUSTRALIA RESOURCES QUARTERLY – KEY POINTS

Source: Sybilla Gross, 2022,"World's Scramble For Energy Drives Australian Exports to Record", Bloomberg Photo by 1: Dominik Vanyi on Unsplash Photo by 2: Jacob Meissner on Unsplash